best buy 401k rollover

A direct rollover or a 60-day rollover. Putting a percentage of savings into silver or gold can insure against losses should Wall st or the.

401k Rollover Investing 401k Investment Portfolio

Leave your old 401k account as is.

. In many cases you can do a direct rollover also called a trustee-to-trustee transfer. 160 plus 4 per participant. Understand Your Options - See When And How To Rollover Your 401k.

The 5-year holding period for Roth IRAs starts on the earlier of. You can roll over a 401 k at any point after you switch jobs or retire. Once the IRA provider receives the rolled-over funds from 401k you can use them to buy gold in various forms.

If youre under age 59½ and you have one Roth IRA that holds proceeds from. 401k rollover - CLICK HERE FOR FREE INFORMATION httpsgooglWIxooQ More and more investors are worrying about the future of the economy and their investments. Gold IRA Rollover Rules.

If you miss the 60-day deadline the taxable. Its a 401 K plan. Diverting a percentage of investment capital into gold or silver can insure against losses should Wall st or.

The Plan Sponsor sometimes called Best Buy is. Ad Merrill Can Help You Understand Your Choices For Your Old 401k. As a result buying physical gold bars and coins has become more popular than ever.

You may have a 401K with your employer and just by leaving your money in that retirement fund will possibly leave short when. Simplify Your 401k Rollover Decision. Fast Professional Independent Expert Business Valuation 3 days.

Cash out the account and pay the taxes and penalties for early. 401k rollover - CLICK HERE FOR FREE INFORMATION httpsgooglZcY2Qu Increasing numbers of investors are concerned about the world economy and their investments. Bear in mind though that the IRS gives you just 60 days after you receive a retirement plan distribution to roll it over to an IRA or another plan.

Ad No Upfront Fees - No Risk. Because of this you cannot do the reverse and roll over money from a Roth 401k to a traditional IRA. This involves your 401 k provider wiring funds directly to your new IRA provider.

Ad It Is Easy To Get Started. A direct rollover and an indirect rollover. Alternatively your 401.

The cash given if the 60-day guideline is broken will be taxed as ordinary income. One of the most prominent option is to invest in gold. There are two rollovers.

Because of the 60-day window for investing gold in a new gold IRA the old gold IRA must be converted into a new gold IRA. There is a 10 early withdrawal penalty if the account holder is under the age of 595. South Richfield MN 55423-3645 Telephone.

Schwab Has 247 Professional Guidance. According to the IRS a 401k rollover can be done in one of two ways. When it comes down to it its just a normal 401k benefit.

The best 401K rollover options really come down to what is the best investment to put your money in. Ad Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K. Roll over the account into an IRA.

And youre only allowed one rollover per 12-month period from the same IRA. However you would then owe taxes on that money for the current tax year as Roth accounts are funded with post-tax dollars. Ad Open an IRA Explore Roth vs.

Heres how to start and finish a 401 k to IRA rollover in three steps. Once You Retire You Wont Pay Taxes When You Withdraw Your Money. Due to this investing in physical gold bars and coins has become extremely popular.

This is because time and time again gold proves to be a very steady financial vehicle. Choose which type of IRA account to open. Best Buy Enterprise Services Inc.

Call us toll free 247 at 800 767-1423. Enter username and password to access your secure Voya Financial account for retirement insurance and investments. Traditional or Rollover Your 401k Today.

The gold IRA allows you to add gold bullion coins and gold bars to your plan. A direct rollover transfers assets from a qualifying retirement scheme. Ad Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K.

Roll over the account into your new employers 401k. An IRA may offer you more investment options. Make a Thoughtful Decision For Your Retirement.

Schwab Can Help You Make A Smooth Job Transition. Current Part-time Sales Advisor in Anaheim CA California. 1 the date you first contributed directly to the IRA 2 the date you rolled over a Roth 401 k or Roth 403 b to the Roth IRA or 3 the date you converted a traditional IRA to the Roth IRA.

Traditional or Rollover Your 401k Today. The best option for holding physical gold is the self-directed IRA. The content of this article is based on the authors opinions and recommendations alone and is not intended to be a source of investment.

Find a comprehensive database of the best New York 401k rollover providers here or call us toll-free at 800 767-1423 today for free live help. This option allows investment in physical gold that you. Learn About The Potential Benefits Of Investing For Your Retirement With Merrill.

Gold Ira Rollover Guide How To Execute 401 K Rollovers To Gold Paid Content Cleveland Cleveland Scene

A Basic Introduction To The 401k Rollover Walletgenius

401 K Rollover The Complete Guide 2022

How To Roll Over Your 401 K And Why Ally

401 K Rollover The Complete Guide 2022

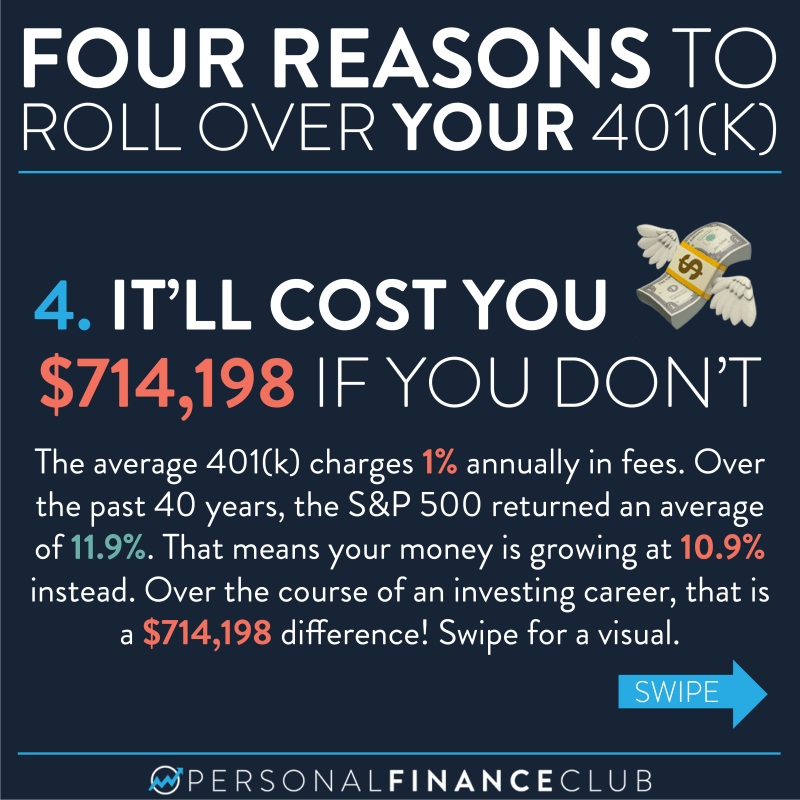

Four Reasons To Rollover Your Old 401 K S Personal Finance Club

Gf 069 Understand Your Why Before You Buy An Annuity Investing And Retirement Investing Finance Tips Understanding Yourself

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Roth Vs Traditional Ira Decision Which Ira Will Maximize Your Money Roth Vs Traditional Ira Traditional Ira Investing For Retirement

Gold Investment News Buying Gold And Investing Your Ira Or 401k Into Gold Is One Of The Best Ways To Have The Secu Gold Investments Buying Gold Ira Investment

What S A 401 K Rollover And How Does It Work Ellevest

401 K Rollover The Complete Guide 2022

Four Reasons To Rollover Your Old 401 K S Personal Finance Club

10 Big 401k Plans Suspending Matching Contributions In 2020 401 K Specialist

Roll Over A 401k Or Ira Rollovers

Rollover Revisited Why Sticking With A 401k May Be Better 401k Rollover Rollover Ira Individual Retirement Account

The Complete 401k Rollover To Ira Guide Good Financial Cents