postmates tax form online

When To File Postmates 1099 Taxes. Customer and merchant issues.

Postmates 1099 Taxes The Last Guide You Ll Ever Need

Try it free with a 7-day free trial cancel anytime.

. Online Tax Forms Included. You dont have to file. Regardless of whether or not you receive a 1099-NEC you must still file taxes with the IRS.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. You can expect to learn. These dates may be extended due to COVID in 2021.

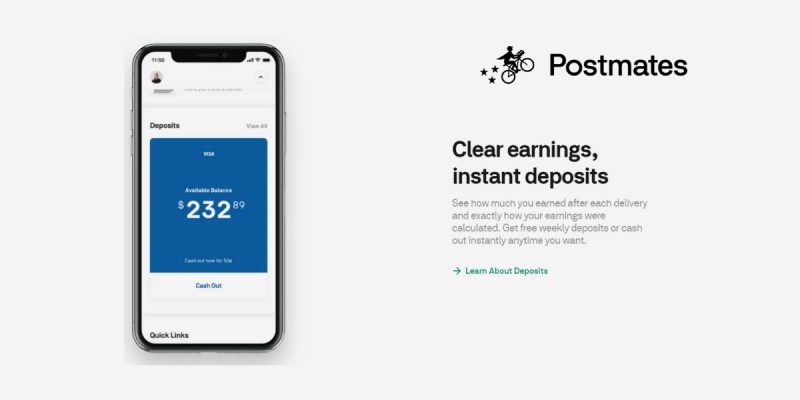

Postmates has joined Uber Eats which means customers and delivery requests have switched to the Uber app as of June 7 2021. If you are expected to owe the IRS 1000 or more when you file taxes then you need to make quarterly estimated income payments. As 1099-NEC forms provide annual income and the tax year is not completed yet the form has not been created at this time.

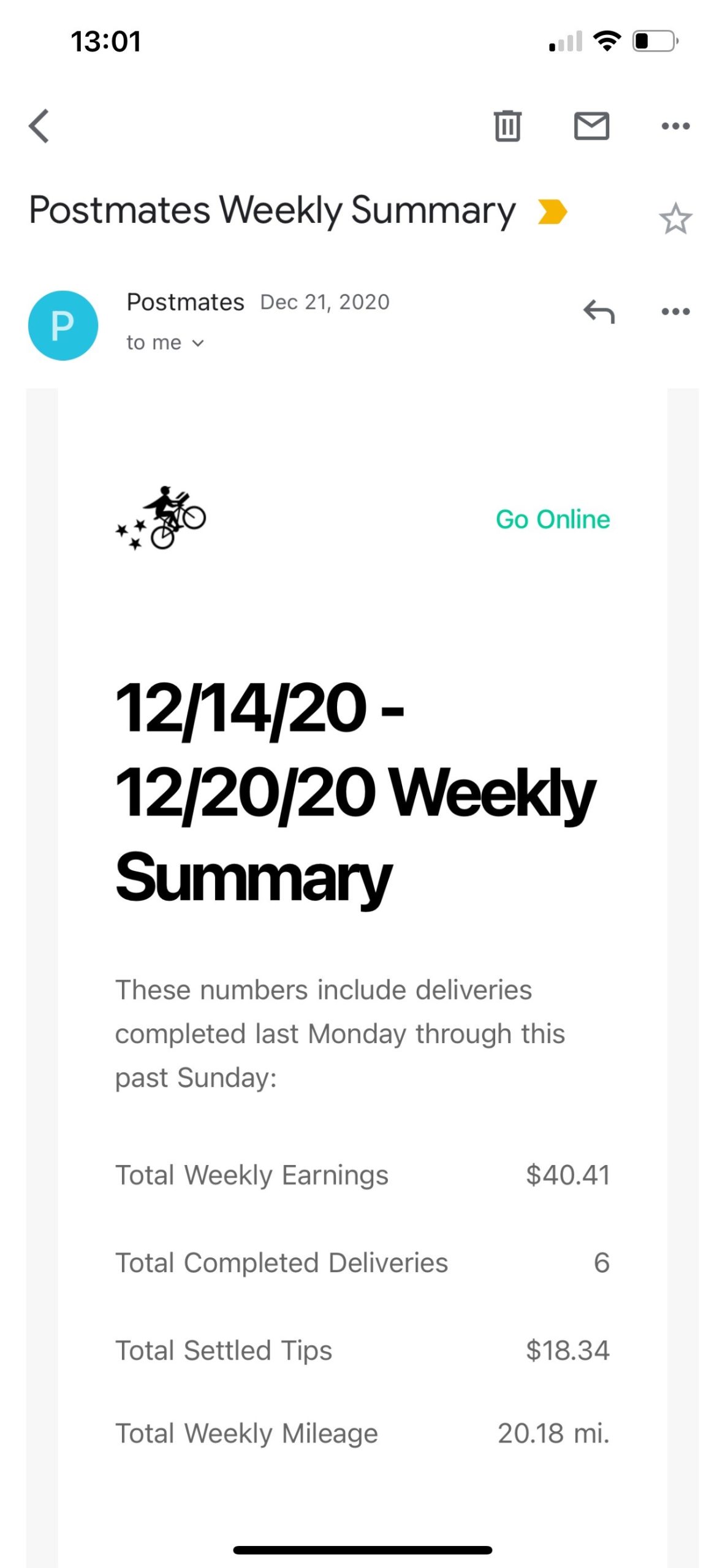

April 15 2020 1116 AM. Taxes 101 for Postmates. Postmates will only prepare a 1099-NEC for you if your earnings exceed 600 in a year.

PostmatesUber Tax Form 1099 Help. Fill Out Your IRS Tax Forms Online Free. Unlimited free deliveryonly for Unlimited members.

1 online tax filing solution for self-employed. At this time 2021 1099-Forms are not available. Postmates drivers are self-employed.

That means you will need to estimate how much you will owe the government by four specific dates a year. This includes 153 in self-employment taxes for Social Security and Medicare. Once you have signed in click on the My Account tab and then select Taxes from the menu on the left-hand side of the screen.

Postmates tax form online Saturday March 19 2022 Edit. Fortunately you can still file your taxes without it. Intricacies of reporting 1099 income.

Americas 1 tax preparation provider. Intuitive Instructions IRS E-File Fast Refunds. 12200 if under age 65.

With that said Postmates driver self-employment means its important to understand the proper way to account for unique delivery driver tax deductions. This is what they said. Does postmates mail us a paper copy of tax forms.

IRS Tax Forms For A Postmates Independent Contractor. Keep track of your expenses throughout the year. Ad 0 Federal Filing.

Download and complete the 1099 form from postmates. Expect to pay at least a 25 tax rate. According to Postmates if you dont meet this requirement you wont receive a 1099-NEC.

As a Postmates delivery driver youll receive a 1099 form. Postmates Tax Deductions Back Story. Your earnings exceed 600 in a year.

On Schedule C you will be able to show your income as well as your expenses. File your taxes correctly and on time. A 1099 form is an information return that shows how much you were paid from a business or client that was not your employer.

Know when to file your taxes. If you have earned 600 or more on the platform in 2021 then a 1099-NEC form will be made available to you in early 2022. While Stride operates separately from Postmates I can tell you that Postmates will only prepare a 1099-MISC for you if.

You get a deduction for 12 of your self-employment tax so your taxable income for income taxes will be slightly lower than your business profit. By linking your Uber Eats account your Postmates delivery account should migrate with you and be displayed in-app on your Uber Profile app. Understand the Postmates Tax Form 1099-K.

However if you have other income over 12200 from another source of income then just add the 25 as an additional source of income. To get your Postmates 1099 online you will first need to sign into your Postmates account. This means Postmates drivers are eligible for Postmates 1099 tax write-offs such as self-employment tax deductions.

I can no longer go online in my Postmates Fleet app. Were hosting this free webinar to help you learn all the tax basics that will make this season a breeze. Account and app issues.

E-File or Print Mail. Make sure you are aware of the types of income that are taxable. TT will ask you for other sources of income in its interview.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Or just emails them. Since Postmates has been acquired by Uber youll need to reach out to Uber for your 1099.

Well give you the quick checklist of items you qualify for to lower your taxable income. It also includes your income tax rate depending on your tax bracket. Use a reputable tax preparer if needed.

How To Get Postmates Tax 1099 Forms Youtube Postmates Taxes The Complete Guide Net Pay Advance The Ultimate Guide To Taxes For Postmates Stride Blog Postmates 1099 Tax Filing The Complete Guide. TurboTax will also add Schedule SE which. If you deliver foods from restaurants using the app here are the deductions you would need to know about for your Postmate taxes.

All about deductions and how to lower your tax bill. Next click on View 1099-MISC and then select Download. Help with a trip.

So if you have determined that you are a contractor you can always call and ask Postmates then you will have to file a Schedule C on your tax return in TurboTax this is the Self-employed version or Home Business. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. With Postmates Unlimited you get free delivery with no blitz pricing or small cart feesever.

Taxes can be confusing and overwhelming but Stride is here to help. 16 Write-Offs For Postmates Drivers. There are many IRS 1099 forms but our guide will only review the most relevant ones for your Postmates taxes.

With Keeper we can automatically categorize your purchases for tax write-offs. A guide to driving and delivering. According to Postmates if you dont meet this requirement.

Tax season is here. Therefore if that 25 is the only income you have.

Postmates Driver Review 2022 Make Money Delivering Stuff

Postmates Driver Review 2022 Make Money Delivering Stuff

How To Get Postmates Tax 1099 Forms Youtube

What Are The Biggest Threats To Postmates Business Model September 2016 Quora

Postmates Driver Requirements 2021 Review Background Check

Postmates Driver Review How Much Do Postmates Drivers Make Gobankingrates

The Ultimate Guide To Taxes For Postmates Stride Blog

Chipotle Sign Saying Staff Walked Out Goes Viral Plus 22 More Similar Signs From Other Us Businesses

Filing Taxes For On Demand Food Delivery Drivers Turbotax Tax Tips Videos

Postmates 1099 Taxes Your Complete Guide To Filing

.png)

Postmates 1099 Taxes The Last Guide You Ll Ever Need

Postmates Driver Review 2022 Make Money Delivering Stuff

How Do Food Delivery Couriers Pay Taxes Get It Back

The Ultimate Guide To Taxes For Postmates Stride Blog

How To Get Your 1099 Form From Postmates

Postmates Driver Review 2022 Make Money Delivering Stuff

The Ultimate Guide To Taxes For Postmates Stride Blog